Money Psychology in Business Checklist | Financial Habits & Bias-Free Decisions

Money Psychology in Business Checklist | Financial Habits & Bias-Free Decisions

Couldn't load pickup availability

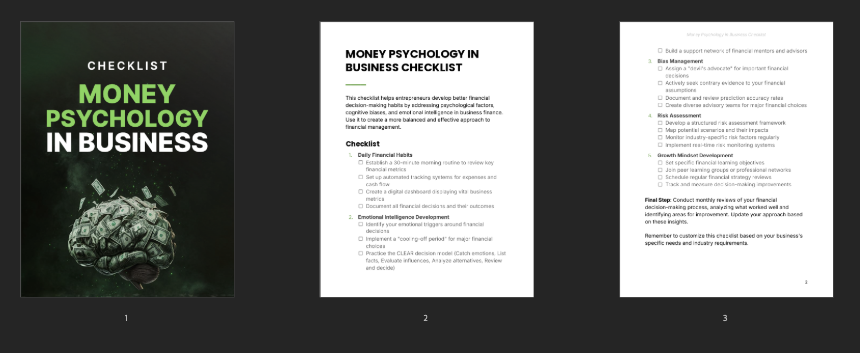

Money Psychology in Business – Checklist helps you make clearer, calmer, more profitable decisions by spotting the hidden mental patterns that shape how you handle pricing, spending, investing, and risk.

A fast, actionable checklist to improve day-to-day money habits, catch cognitive bias before it costs you, and evaluate business risk with a clear head.

What you get

- Daily money habits reset (quick routines that actually stick)

- Decision checkpoints to reduce impulsive spending and discounting

- Bias spotters for common traps like loss aversion, anchoring, and confirmation bias

- Simple risk review steps before major purchases, hires, or investments

Perfect for

- Entrepreneurs, freelancers, and small-business owners

- Anyone who wants fewer impulse decisions and more consistent financial habits

- Teams who need a shared decision process (spend, hire, invest, discount)

Format: PDF content inside a ZIP file. Length: 2 pages.

Q&A (common search questions)

Q: Is this good for improving business decision-making?

A: Yes—it's built around practical steps to reduce cognitive bias, improve money habits, and assess risk before you commit.

Q: Can I use this as a business finance checklist/workbook/guide for my routine?

A: Absolutely. Use it weekly or monthly to review cash flow behaviors, decision triggers, and risk tolerance.

Q: Who is this for?

A: Founders, solopreneurs, finance-minded creators, and anyone running a business who wants more rational, repeatable money decisions.

Q: What will I learn?

A: How emotions and biases affect financial choices, and how to apply simple frameworks to make smarter calls.

Q: Does it cover budgeting and cash flow habits?

A: Yes—along with mindset shifts and a structured approach to risk and evaluation.

Share